In today’s world, cars have become a necessity for many people. If you’re in the market for a new or used car, financing can be a great option to help you afford the vehicle you need.

There are many different car financing options available, so it is important to shop around and compare rates before making a decision. By following these tips, you can get the best car financing deal possible.

Before you start shopping for a car loan, it is important to do your research and understand the different types of financing options available.

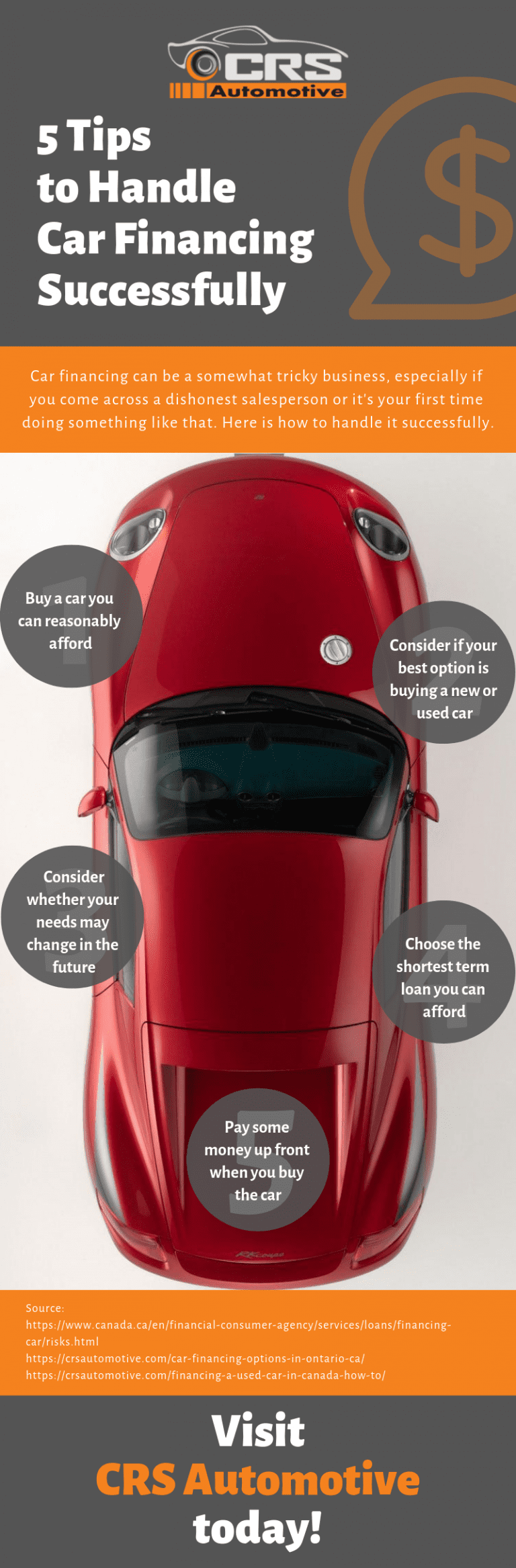

Tips for Car Financing

To get the best deal on a car loan, it’s important to consider the following:

- Shop around.

- Compare rates.

By doing your research, you can find a lender that offers a competitive interest rate and terms that meet your needs.

Shop around.

When it comes to car financing, shopping around is one of the most important things you can do to get the best deal. Don’t just accept the first loan offer you get from your bank or credit union. Take the time to compare rates and terms from multiple lenders.

There are a few different ways to shop around for car financing. You can visit each lender’s website and compare rates, or you can use a car loan comparison website. Car loan comparison websites allow you to enter your information once and then receive quotes from multiple lenders.

When you’re shopping around for car financing, be sure to compare the following:

- Interest rate: This is the amount of money you’ll pay each year to borrow the money.

- Loan term: This is the amount of time you’ll have to repay the loan.

- Monthly payment: This is the amount of money you’ll pay each month to repay the loan.

- Fees: Some lenders charge fees for processing the loan, paying it off early, or making late payments.

By comparing these factors, you can find a car loan that meets your needs and budget.

Shopping around for car financing can save you a lot of money in the long run. By taking the time to compare rates and terms, you can find a lender that offers a competitive interest rate and terms that meet your needs.

Compare rates.

Once you’ve found a few lenders that you’re interested in, it’s time to compare rates. The interest rate is the amount of money you’ll pay each year to borrow the money. A lower interest rate means you’ll pay less for the loan over time.

- Check your credit score. Your credit score is a major factor in determining the interest rate you’ll qualify for. The higher your credit score, the lower your interest rate will be.

- Compare rates from multiple lenders. Don’t just accept the first rate you’re offered. Take the time to compare rates from multiple lenders. You can use a car loan comparison website to make this process easier.

- Consider the APR. The APR (annual percentage rate) is the total cost of the loan, including the interest rate and any fees. The APR is a more accurate measure of the cost of the loan than the interest rate alone.

- Look for special offers. Some lenders offer special rates or discounts to certain borrowers, such as military members, recent college graduates, or first-time car buyers.

By comparing rates, you can find a car loan that offers a competitive interest rate and saves you money in the long run.

FAQ

Here are some frequently asked questions about car financing:

Question 1: What is the best way to shop for a car loan?

Answer 1: The best way to shop for a car loan is to compare rates and terms from multiple lenders. You can do this by visiting each lender’s website or using a car loan comparison website.

Question 2: What factors affect the interest rate I qualify for?

Answer 2: The interest rate you qualify for is based on a number of factors, including your credit score, the loan amount, the loan term, and the type of vehicle you’re financing.

Question 3: What is the APR?

Answer 3: The APR (annual percentage rate) is the total cost of the loan, including the interest rate and any fees. The APR is a more accurate measure of the cost of the loan than the interest rate alone.

Question 4: What are some special offers that lenders may offer?

Answer 4: Some lenders offer special rates or discounts to certain borrowers, such as military members, recent college graduates, or first-time car buyers.

Question 5: What is the best way to improve my credit score?

Answer 5: There are a number of things you can do to improve your credit score, including paying your bills on time, keeping your credit utilization low, and disputing any errors on your credit report.

Question 6: What should I do if I have bad credit?

Answer 6: If you have bad credit, you may still be able to get a car loan, but you may have to pay a higher interest rate. You can also consider getting a co-signer with good credit to help you qualify for a loan.

Closing Paragraph for FAQ:

These are just a few of the most frequently asked questions about car financing. If you have other questions, be sure to ask your lender or a financial advisor.

Now that you know more about car financing, you can start shopping for the best loan for your needs. By following the tips in this article, you can get the best deal on a car loan and save money in the long run.

Tips

Here are some practical tips for getting the best car financing deal:

Tip 1: Determine your budget before you start shopping.

Knowing how much you can afford to spend on a car will help you narrow down your options and avoid overspending.

Tip 2: Shop around and compare rates from multiple lenders.

Don’t just accept the first loan offer you get. Take the time to compare rates and terms from multiple lenders to find the best deal.

Tip 3: Consider getting a co-signer if you have bad credit.

If you have bad credit, you may still be able to get a car loan if you have a co-signer with good credit.

Tip 4: Make a larger down payment if possible.

Making a larger down payment will reduce the amount of money you need to borrow and save you money on interest in the long run.

Closing Paragraph for Tips:

By following these tips, you can increase your chances of getting the best car financing deal possible.

Now that you know more about car financing and have some practical tips to follow, you’re well on your way to getting the car you want at a price you can afford.

Conclusion

By following the tips in this article, you can get the best car financing deal possible.

Here are the main points to remember:

- Shop around and compare rates from multiple lenders.

- Consider getting a co-signer if you have bad credit.

- Make a larger down payment if possible.

- Read the loan agreement carefully before you sign it.

By following these tips, you can save money on your car loan and get the car you want at a price you can afford.

Closing Message:

Getting a car loan is a big financial decision. By doing your research and shopping around, you can make sure you’re getting the best deal possible. With a little planning, you can get the car you want at a price you can afford.